Blog

Featured Posts

-

Labor and Employment Law

View More -

Low-Income Help

-

Consumer Protection Laws

View More -

Divorce and Separations

View More -

General Fairfax County

View More -

Landlord Tenant

View More -

Child Custody

View More -

Discovery

-

Family Law

-

COVID-19

-

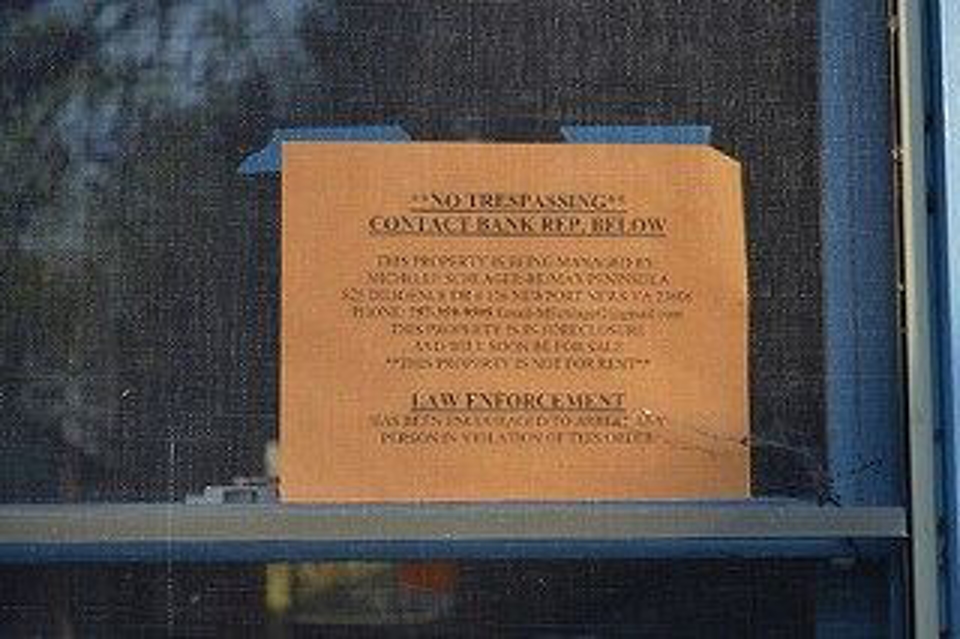

Virginia Residential Evictions: COVID-19 and the Virginia Residential Landlord and Tenant Act

Virginia Residential Evictions: COVID-19 and the Virginia Residential Landlord and Tenant Act -

What Quarantining Does to High Conflict People and Narcissists: Narcissism, Coronavirus, and Lack of Narcissistic Supplies are Perfect Ingredients for High-Conflict Divorces and Tips for Staying Safe and Sane

What Quarantining Does to High Conflict People and Narcissists: Narcissism, Coronavirus, and Lack of Narcissistic Supplies are Perfect Ingredients for High-Conflict Divorces and Tips for Staying Safe and Sane

-

-

Divorce

View More -

Equitable Distribution

-

Parental Alienation

.2202011027550.jpg)

.2202151307550.jpg)

.2110200851550.jpg)

.1907250839550.jpg)

.1906240954550.jpg)

.1).1902131553550.jpg)

.1903180949550.jpg)

.1904191458550.jpg)

.1909041034550.jpg)